- Finance

- Shopping Tools

Texas Boat Loan And Financing Guide.

Discover the lowest interest rates for a boat loan in Texas. Compare over 20+ banks, same day approvals, and money as fast as 24 hours.

Boat Loan Calculator For Texas

Boat Loan Calculator

Find out how much you need to budget for the boat you love.

Your Monthly Payment

$0.00/ mo

7.49% APR (Estimate based on your credit raiting)*

Instantly pre-qualify, same day approvals, and funding as fast as 24 hours!

No Impact to your credit score.

Boat Loan Interest Rates In Texas

Current Texas boat loan rates as of 24th April, 2025.

Texas boat Loan rates can vary on factors such as credit score, credit history, the loan amount, term of the loan, and even the lender or bank you choose.

| Credit Score | Boat Loan Rate |

|---|---|

| 800+ | From 6.75% |

| 760-799 | From 7.00% |

| 740-759 | From 7.25% |

| 700-739 | From 7.75% |

| 680-699 | From 8.25% |

View Boat Loans In Texas for New and Used Boats

Boat Loan For New Boat

In the market for a new boat? View the most competitive boat loan rates in Texas.

Boat Loan for Used Boat

Instantly pre-qualify for a boat loan for used boat in Texas.

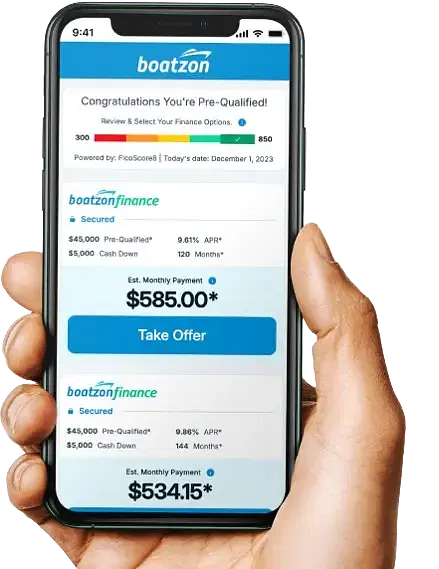

How to get a Texas boat loan on Boatzon

Compare over 20+ bank offers and find the lowest rate for your boat loan

Instantly pre-qualify today with no impact to your credit score

We are the only company to show you real, locked boat loan rates online

We’ve helped boat buyers purchase over 1 Billion dollars in boat loans

Lots of great information

Jeff was great. Precise and informative. Couldn't have asked for better help

Great

Received a rapid response to my email sent. Also, was very appreciative of their time & help in ser

Jeffrey was extremely professional and helpful.

Jeffery Steiner was extremely helpful with the process.

Very professional , very easy to talk to .Process was painful . Very rewarding individuals very go

Jeffrey was very attentive, knowledgeable, and easy to work with. Made my shopping a lot less stres

Just in speaking with the gentlemen, he was courteous and professional.

Great service

I applied, they emailed me within 12 hours to set up a call. The customer service was great and the

Very friendly and quick service! I will recommend to anyone!

Customer service is top notch!!!

Jeffrey was amazing and was extremely easy to speak too. He answered all my questions and explaine

Excellent Experience!! Jeffrey Steiner and his team are the best! Highly Recommend!

Prompt and courteous

mr Steiner was great help and answered all my questions without pause.

Very helpful!

Extremely satisfied

Jeff was personable and knowledgeable in assisting me with boat loan options. I highly recommend sp

Jeff Steiner was great, a big help. I can't wait to find a boat!

Spoke with a really nice guy named Jeffrey, he explained how everything worked and just waiting to

I want to thank Jeffrey to reaching out and helping us with our boat process great customer service

Jeffrey was straight forward and help me as much as he could. I would recommend you to everyone. Th

Easy, professional

Jeffrey was very helpful and knowledgeable and i would refer him to all my friends Joe T

very nice and helpful

Jeffrey Steiner was very helpful and informative - within just a few minutes he had addressed all m

I qualify on 2 out of 3 points. Given advice how to get 3 out of 3 and help qualify

Enjoyed the overall experience, very thorough and a pleasure to work with, will definitely recommen

God bless u all

Agent was awesome!

Jeffrey Steiner was friendly, fast and informative just like the old days great job!!!!

Couldn't be more satisfied with the help from Jeff. And the process of my loan from boatzon. If you

Jeffery Steiner was very helpful in identifying potential lenders for a used vessel purchase. The

Good

Jeffrey was exceptional with the process. I had my loan approved in 24 hours. I have applied many t

Very helpful and great people to work with

Everyone at Boatzon was very helpful at helping to fund our boat. Easy process. Will highly recomme

Debbie Pettibone was amazing. Super helpful and friendly. She should get a raise!

Zach did an A+ job processing our Loan.

Very easy. Debbie was great to work with. Thank you

Excellent Service!

Chelsea is AMAZING! Knows what she is doing, is very efficient, and so fun to work with!

Debbie was great to work with and keep me updated at all times. Thank you

Everyone that we spoke to was very friendly and helpful our transaction was smooth and stress free

Julia was top notch, excellent communication. Thank you

Thanks to everyone that worked on this. It was fast and easy. Thank you all!!!!!

You guys were amazing. I was trying with another financial group and they were taking so long and I

It was honestly the easiest process ever..I initially thought Boatzon could have been some sort of

Great experience! Everyone was very courteous and knowledgeable. Received approval in 1 business da

Great experience! Everyone was very courteous and knowledgeable. Received approval in 1 business da

Worked with Debbie and her partner Ian who were timely and responsive. Had a couple other options

Zach was excellent

I started the buying process with Boatzon and their affiliates on a Monday morning and was on the w

I want to thank you all for the easiest , positive experience with your company! I was a little un

Stephen was a great professional who guided me through the whole purchase process. On a daily basis

Exceptional ..!!!

Max did a great job for me. He was very patient with a number of issues that I had that slowed the

These guys work diligently and stay in constant communication with you. 10/10 recommend!

I could not say enough great things about boatzon the person that was helping me Ian Went above an

Fast and easy. Took only 5 days to close once I found my boat.

Entire process was very quick and easy.

I can't thank Jennifer and Evie enough for all of their work. They were in constant communication w

Ian was our finance guy and he went above and beyond helping us get everything we needed done. The

I was having difficulties getting a loan thru my credit union due to my income source of being disa

Very simple process. I do recommend Boatzon.

Jenifer she helph me on all details

What a great company to work with from start to Finish Kristen was on top of everything , everyday

Ian Was Very informative and accommodating. He kept me up to date and helped with the whole process

Justin and his team was definitely on top of things and quick to respond and help me thru the proce

The staff was amazing and always on point with reminders and willingness to work for you overall id

Kristen Conroy was very professional and helpful with the process. She even stepped in and called

Stephen reached out to me after I submitted an application -let me know I had been approved, how th

Navigating Texas Boat Loans

Looking for a boat loan in Texas? Whether you're a first-time buyer or looking to upgrade, getting a boat loan can make your dreams a reality. However, there are a lot of financial institutions and loan options available, so it’s understandable if you find navigating the boat loan process a bit… well… overwhelming.

Where do you start? No worries. We’re here to help.

We understand the importance of finding the right loan that fits your needs and budget. So… our team of experts has put together this comprehensive guide to help you make the right decision about a Texas boat loan. From understanding interest rates and loan terms to exploring the various loan options available, we have the information you need. We'll also provide valuable tips on how to improve your chances of getting approved for a boat loan and how to compare different lenders to find the best deal.

Don't let concerns about boat financing keep you from realizing your dream. We are your trusted guide to demystify and simplify the process of securing a Texas boat loan.

Benefits of Financing a Boat in Texas

Financing a boat in Texas allows more people than ever to afford the joys of boat ownership. Let’s break down the benefits.

Flexibility One of the big advantages is flexibility in loan terms and repayment options. Unlike other states, Texas doesn't impose strict regulations on boat loans, so lenders can offer a wide range of loan terms. You can choose a loan with a longer term to lower your monthly payments or opt for a shorter term to pay off your boat sooner and save on interest. Good deal for you.

Tax Breaks Another significant benefit of financing a boat in Texas is the potential tax advantages. In Texas, the sales tax on boats is capped. Yup. There’s a limit to how much tax you’ll have to pay when buying a boat. While the use tax rate is 6.25%, the total amount of sales tax collected cannot exceed $18,750. This can make it more affordable compared to other states. Plus, interest paid on boat loans may be tax-deductible as well.

Longer Boat Season When you have a boat in TX, you get more months to enjoy it. Long, sunny days last longer here, so you can stay on the water while everyone up North has started cleaning their engines and preparing their boats for winter. It’s easier to spend time enjoying your purchase year-round in warmer regions, including Texas and other Southern states. It’s also more comfortable to swim in these places since the water temperature is higher. Nice! Financing a boat in Texas allows you to enjoy all of the waterways and coastal areas that the state offers. There are a whole bunch of opportunities for boating and water activities, like fishing in Galveston Bay, exploring scenic Lake Travis, or cruising along the Gulf of Mexico. Not including the coast, there are 150 lakes, 15 rivers, and thousands of streams you can explore.

Understanding the Different Types of Boat Loans

Before diving into the boat loan application process, you need to understand the different types of boat loans available in Texas. The two main types are: • Secured loans • Unsecured loans

Secured Loans Secured boat loans require collateral, typically the boat itself, although you may choose to use other collateral. Like anything else, there’s some good news and some bad news. The bad news? If you fail to repay the loan, the lender can repossess the boat to recover their losses. The good news? Secured loans usually have lower interest rates compared to unsecured loans because the lender has a way to recoup their investment if you stop paying what you owe. These loans are ideal for those looking to finance a new boat or a used boat in good condition.

Unsecured Loans Unsecured boat loans do not require collateral and are based on your credit history and general creditworthiness. Since these loans are a bit riskier for lenders, they often come with higher interest rates. Unsecured loans are typically used for smaller boat purchases or borrowers with excellent credit scores and a stable financial history. If you’ve got a great credit score, you can generally get rates.

Secured or Unsecured Loans: Which Is Right for Me? When deciding between a secured or unsecured loan, consider your financial situation, credit score, and the value of the boat you intend to purchase. Secured loans may offer better rates but require collateral, while unsecured loans may work if you have good credit — but may get higher interest rates.

Factors to Consider Before Applying for a Boat Loan in Texas

Before you apply for a boat loan in Texas, there are a few things you need to know to make the application process go smoothly, such as understanding the impact of your: • Credit score • Debt-to-income ratio • Downpayment

Credit Score Your credit score plays a crucial role in determining your eligibility for a boat loan and the interest rate you will be offered. Lenders use credit scores to assess your creditworthiness and evaluate the risk of lending you money. A higher credit score generally leads to better loan terms and lower interest rates. It’s a good idea to check your credit score before applying for a boat loan and take steps to improve it if necessary. You can get a free credit report from the three major credit bureaus annually and it’s worth checking. Unfortunately, there are sometimes errors on credit reports and you’re better off finding and fixing them before applying for a loan.

Debt-to-Income Ratio The debt-to-income ratio (DTI) is the percentage of your monthly income that goes towards paying your debt. Lenders prefer borrowers with a low DTI as it indicates a lower risk of default. Before applying for a boat loan, calculate your DTI and aim to keep it below 40% to increase your chances of approval.

Calculating Your Debt-to-Income Ratio To do so, add up all of your monthly debt payments and divide them by your gross monthly income. For example, if you pay $2,000 a month for your mortgage and another $1,000 a month for a car loan and credit cards, your debt payments equal $3,000 a month. If your monthly income is $8,000, your debt-to-income ratio is 37.5%. If you are unsure whether you would qualify, you can check with different lenders and ask their opinion before applying. And know this: About 61% of boat owners here in Texas have a household income of $75k or less. So, if you’re not a gazillionaire, you can still own a boat.

Down Payment The bigger the down payment, the lower your monthly payments will be. The amount of your down payment can also significantly improve your odds of getting loan approval and lower interest rates. By saving for a bigger down payment, you can improve your loan terms and —potentially — save thousands of dollars in interest over the life of the loan.

So, How Do You Find the Best Boat Loan Rates in Texas? Finding the best TX boat loan rates will take a bit of research on your part. Interest rates are influenced by factors such as your creditworthiness and loan term, and different lenders may offer varying rates for the same borrower and boat. Start by reaching out to local banks, credit unions, or online lenders that specialize in boat financing. Not every financial institution does. Get quotes from multiple lenders and compare the interest rates, loan terms, and any additional fees or charges. Don’t forget about online options. Comparison websites can also be a great resource to shop for the best boat loan rates in Texas.

When comparing loan offers, focus not only on the interest rate but also on the overall cost of the loan. Consider factors such as: • Loan term • Prepayment penalties • Total amount repayable over the life of the loan

By considering the entire picture, you can make a better decision and choose the best boat loan that fits your comfort level.

The Boat Loan Application Process in Texas

Once you've done your research and found the best boat loan rates in Texas, it's time to start the application process. First, you should get quotes from lenders for the best interest rates on boat loans. Then, you can address the application process by yourself. Although every lender might differ in their particular demands, common general procedures that lenders follow are generally the same.

Here are the key steps:

Gather your financial documents Before applying for a boat loan, get together all the financial documents that you will need such as copies of your ID, banking details, pay slips, and tax returns. Lenders will go through these documents in order to understand your appraised economic status and your repayment capacity.

Submit your loan application Fill out all the items required in the application form provided by the lender. Make sure that all the information is correct and up to date. Also, remember to double-check the facts before you send it to eliminate any delivery setbacks or other problems.

Wait for approval After applying to the lending company, they will have to review your financial records as the purpose of this assessment is to determine your creditworthiness. They will assess your creditworthiness by employing methods such as credit score and credit history inquiry. It takes from several hours to a few days, with different lenders having individual procedures for the same.

Provide additional documentation (if requested) In some instances, the lender may need to review your application more closely in order to provide a greater level of detail by inquiring about certain aspects. Also, have the documents readily available so that the lender or insurer can decide within the required turnaround times.

Receive loan approval and sign the loan agreement In case of your application to be accepted, a loan agreement will be forwarded to you where you will have to sign on the line, such obligations of yours as repayment terms have already been outlined in it. Check it carefully for both you and any other adults need to sign. In cases where there is no full understanding, you should not hesitate to contact the lender for a proper explanation.

Complete the loan closing process Upon finalization of the loan agreement, the lender will convey to you the required steps of the loan closing process. Such a task usually includes getting the condition of the boat inspected, getting insurance coverage, and finally the release of the loan amount.

Celebrate! You’re a boat owner. Congratulations! Take it easy and start the fun!

By practicing the steps presented and maintaining order throughout the process, you will have higher chances of gaining the approval of your Texas boat loan.

Tips for Boat Loan Approval in Texas

You can improve your odds of getting approved and good rates for a boat loan in Texas with careful preparation and attention to detail. Here are some tips: • Improve your credit score: Before applying for a boat loan, review your credit score and take steps to improve your credit score. First and foremost, clear all debts, pay bills on time, and reduce your credit card debt. Moreover, a responsible borrower should show their creditworthiness to lenders by applying, making, and repaying within the approved bills. Having a higher credit score will provide you with more advantage thus, you will be able to be approved for a loan and will have better loan terms. • Save for a down payment: A larger down payment not only reduces the amount you need to borrow but shows you’ve got more skin in the game. Defaulting on a loan with a downpayment means forfeiting the money you put toward the purchase. Save for a substantial down payment to improve your loan approval chances and potentially secure better interest rates. • Minimize your debt-to-income ratio: Keep your debt-to-income ratio below 40% to increase your chances of approval. Reduce your financial burden by clearing off your existing debts, improving your ability to do so, or consolidating them to lessen your monthly debt obligations. • Shop around for loan offers: Don't settle for the first loan offer you receive. Shop around and get quotes from multiple lenders to compare interest rates, loan terms, and fees. This will help you find the best loan offer that works best for you. • Consider pre-approval: Seeking pre-approval for a boat loan can give you an advantage when negotiating with sellers. Pre-approval shows that you have your financing lined up and are a serious buyer. Boat sellers love this!

One thing not to do is to close credit accounts. It’s a good idea to pay them off, but open credit accounts like credit cards help increase your total available credit and result in lower utilization scores. This shows that you use credit responsibly. Plus, the length of time you’ve had credit makes a difference, too.

Realize Your Dream of Boat Ownership in Texas

By implementing these tips and carefully considering your options, you can improve your chances of getting approved for a boat loan in Texas. Make your dream of owning a boat a reality and enjoy!

Mistakes to Avoid

Applying for a boat loan can be an exciting process, but it's important to avoid common mistakes that can hurt your chances of approval. Here’s a list:

• Not reviewing your credit report: Before applying for a boat loan, review your credit report to ensure all the information is accurate and up to date. Dispute any errors or discrepancies that may negatively impact your credit score. • Taking on too much debt: Avoid taking on additional debt before applying for a boat loan. Lenders consider your debt-to-income ratio, and taking on new debt can increase your monthly obligations and affect your loan approval chances. • Overlooking the total cost of the loan: While a low interest rate may be appealing, it's crucial to consider the overall cost of the loan. Consider the loan term, any fees or charges, and the total amount repayable over the life of the loan. • Not considering insurance costs: Boat insurance is a requirement for most lenders, and the cost can vary depending on the type of boat and coverage. Factor in the insurance costs when assessing your budget and loan affordability. • Failing to research the boat's value: Before finalizing a loan, research the value of the boat you intend to purchase.

Overpaying for a boat can result in negative equity and affect your ability to refinance or sell the boat in the future.

Live the Dream of Boat Ownership in Texas Securing a boat loan in Texas doesn't have to be overwhelming. By understanding the different types of financing options, finding the right boat loan is easy.

So, follow these tips, grab your captain's hat, and join the 922,000 other boat owners cruising Texas waterways.

Recent Boat Buying Tips & Reviews

The Top 8 Flats Boats Manufacturers of 2024

The Top 8 Flats Boats Manufacturers of 2024

4 minutes | May, 13, 2023A Closer Look at the Cost of Boat Ownership

A Closer Look at the Cost of Boat Ownership

5 minutes | April, 25, 2023Popular Nearby States

Copyright © 2025 Boatzon™. All Rights Reserved